Keywords: Leaving Certificate study notes, Leaving Certificate Accounting notes, control accounts, accounts control, ledger control, reconciliation, subsidiary ledgers, general ledger, financial controls, account monitoring, control account management.

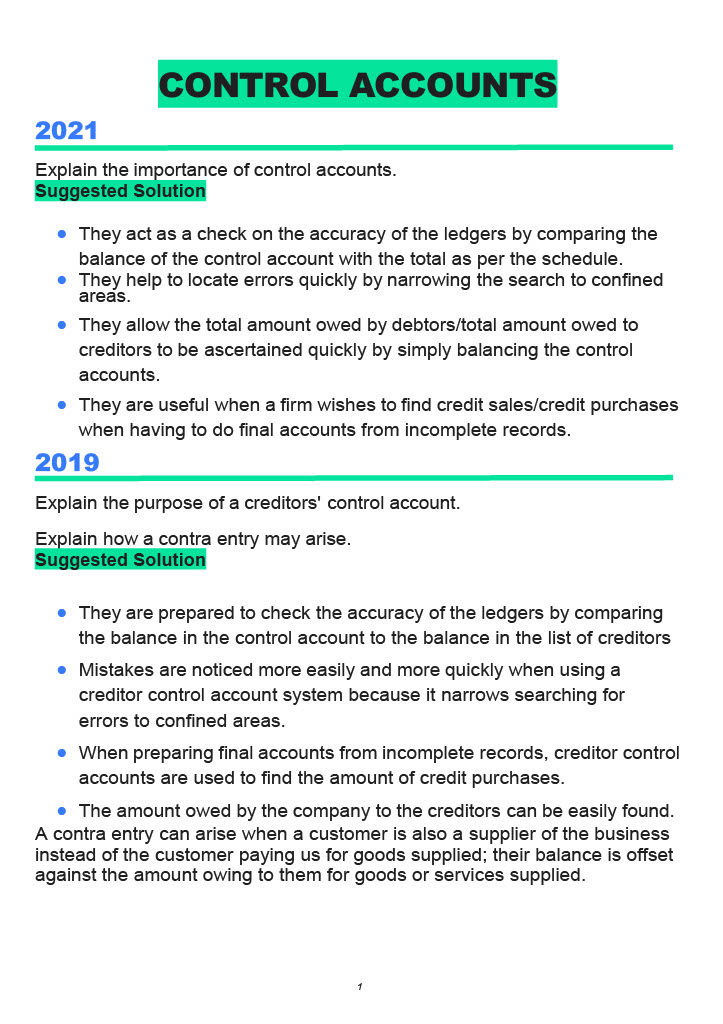

Key Lessons: Leaving Certificate Accounting Notes – Control Accounts What are Control Accounts?: Control accounts summarize transactions for specific categories, such as debtors (accounts receivable) and creditors (accounts payable), ensuring accurate and efficient record-keeping. Purpose of Control Accounts They act as a check on the accuracy of ledger entries. Help detect errors or fraud by reconciling totals with individual ledger accounts. Simplify the preparation of financial statements.

Debtors and Creditors Control Accounts Benefits of Using Control Accounts They save time by providing an overview of balances. Help identify discrepancies quickly, such as missing or incorrect entries. Ensure accurate financial reporting and decision-making.

Common Adjustments in Control Accounts: Adjustments may include discounts, returns, bad debts, or interest charges, ensuring that the control accounts reflect accurate and up-to-date balances.

|

Important Takeaways: Leaving Certificate Accounting – Control Accounts Purpose of Control Accounts: Control accounts serve as summaries for debtor and creditor transactions, helping businesses quickly calculate the total amounts owed to and by them while maintaining accurate financial records. Key Functions of Control Accounts They ensure accuracy by cross-checking balances with individual ledger accounts. Assist in locating errors efficiently by narrowing down discrepancies to specific areas. Simplify the preparation of financial statements, particularly when working with incomplete records.

Understanding Contra Items: A contra item occurs when a customer is also a supplier. Instead of processing separate payments, the amounts owed are offset against each other, simplifying the reconciliation process. Limitations of Control Accounts: While useful, control accounts do not detect certain errors, such as those of omission, commission, or original entry, and cannot specify which individual account may have an issue. Benefits of Control Accounts Accelerate error detection and correction. Provide a clear overview of debtor and creditor balances. Enhance the efficiency of managing credit sales, purchases, and financial reporting.

|

Keywords: Leaving Certificate study notes, Leaving Certificate Accounting notes, control accounts, accounts control, ledger control, reconciliation, subsidiary ledgers, general ledger, financial controls, account monitoring, control account management.

コメント